Is Epic getting too big—and is that a problem for mid-revenue cycle professionals? View our survey results

By Brian Murphy, Norwood Solutions

Cory Doctorow coined the term “Enshittification” to describe the unfortunate path many tech companies take, from greatness to ghetto.

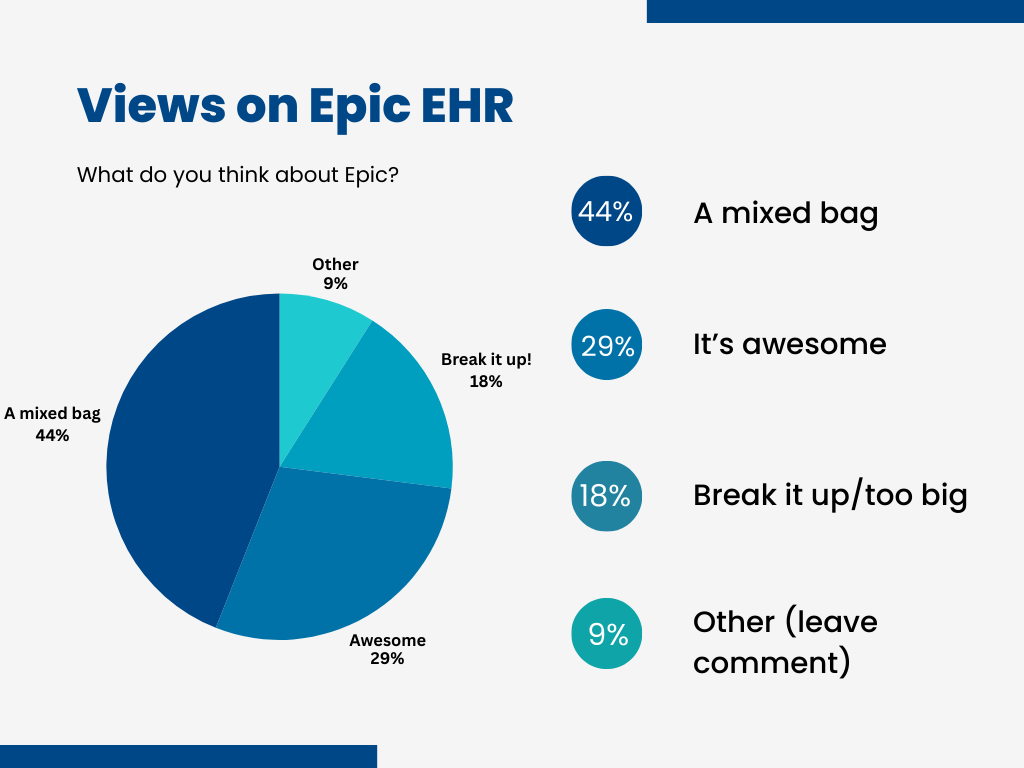

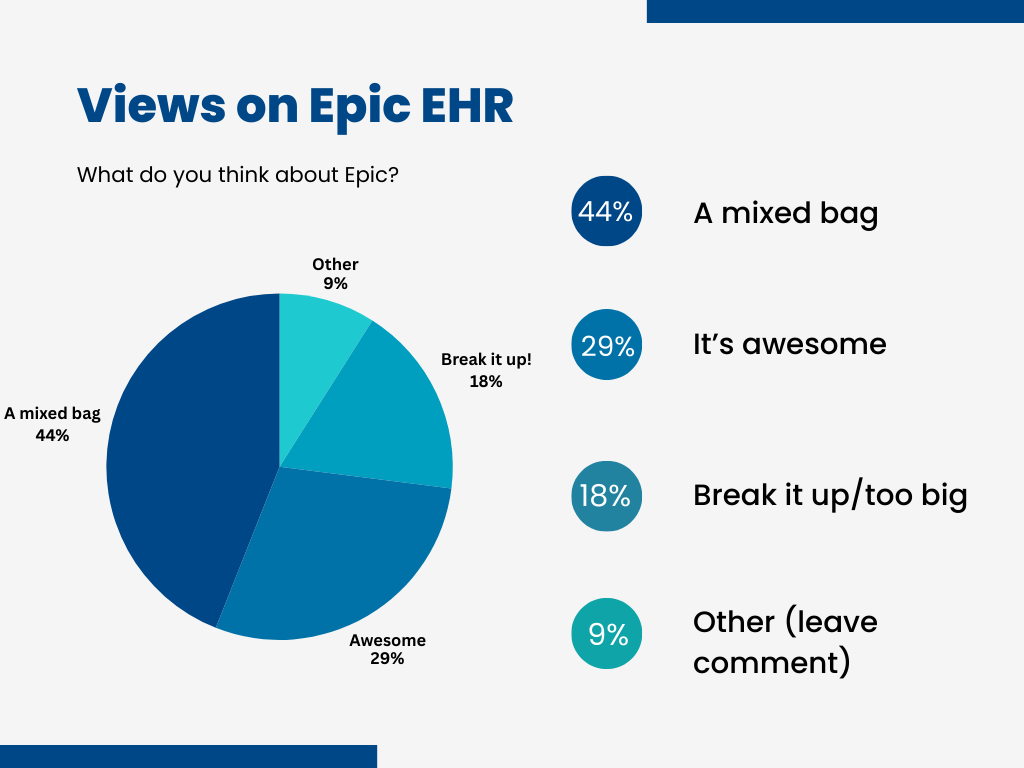

Is EHR giant Epic headed down that path? I presented a poll on LinkedIn in August to my followers, mainly mid-revenue cycle professionals. The results are included in the graph below.

What is enshittification? It’s a four-step slide from awesome product to something on the bottom of your foot.

- Platforms are initially good to attract lots of users, locking them in.

- Once users are locked in, the platform tilts benefits toward advertisers/sellers, and locks them in, too.

- Eventually, it maximizes value extraction for itself, screwing both users and businesses.

- The platform collapses and dies, although many hang on because of the network effect (everyone uses them and the cost of switching is too high).

I recommend watch Doctorow’s video; once you see the pattern you can’t unsee it. While his ire is directed at Google and Apple, I worry about the same thing occurring in healthcare with our 800-pound gorilla EHR equivalent.

I could be wrong. And I do think right now Epic is a good product. I get the sense many (most?) users are pretty happy with it. Guests on my podcast report high satisfaction. Our team at Norwood has done innovative work building out Epic’s Enhanced Risk Adjustment (ERA) framework with our partners, with success.

But there are warning signs.

Epic is not a monopoly but that seems inevitable. Per KLAS data (2024), Epic:

- Contracts with 42.3% of all U.S. acute-care hospitals

- Covers 54.9% of acute-care beds, an increase from 39.1% hospital share in 2023

Cerner was once its biggest challenger, but since its VA implementation woes and Oracle acquisition it’s bleeding customers (see below) and I wonder how long it will last as a viable EHR competitor.

Per Doctorow the way out of enshittification is regulation, competition, and interoperability, but there are troubling signs here too. Epic is now building of all of its own features, crowding out competitors and tech partners alike. Take a look at the aggressive rollout plan below, which includes autonomous coding and documentation from AI cameras.

Then there’s the lawsuits.

Earlier this year CureIS Healthcare slapped Epic with a lawsuit for an alleged ‘scheme to destroy’ its business. That follows on the heels of health tech company Particle Health, which filed a September 2024 antitrust lawsuit against Epic, accusing the EHR giant of stifling competition in the payer interoperability market.

CureIS wrote as part of a 40-page complaint, “This stranglehold enables Epic to eliminate perceived competitors and insulate itself from market-driven incentives to improve or innovate its own products, permanently lowering the bar for everyone.”

Last week I brought my Dad to his annual wellness visit and his provider was unable to get immediate access to his lab values. The practice uses AthenaHealth; his hospital housing the labs, Epic. Whether this is user error or another small sign of enshittification I don’t yet yet know.

Would love to hear your thoughts.

References

- Youtube, Cory Doctorow at Cloudfest 25: How Enshittification Conquered the 21st Century and How We Can Overthrow It: https://youtu.be/_Ai-fC-2Bpo?si=fGWxxDH-F288shmN

- Fierce Healthcare: “CureIS Healthcare hits Epic with lawsuit for alleged ‘scheme to destroy’ its business”: https://www.fiercehealthcare.com/health-tech/epic-hit-lawsuit-cureis-healthcare-alleged-scheme-destroy-its-business

- Healthcare Dive: “Oracle Health’s market share declined ‘substantially’ after Cerner buy”: https://www.healthcaredive.com/news/oracle-health-lost-customers-satisfaction-stagnated-cerner-acquisition-klas-research/758427/

- Becker’s: “What’s coming in Epic — in 2025 and beyond”: https://www.beckershospitalreview.com/healthcare-information-technology/ehrs/whats-coming-in-epic-in-2025-and-beyond/