Explosive growth of Medicare Advantage covered lives requires organizational mindset shifts

By Jason Jobes, SVP Consulting

How do you incorporate the growth of rate of Medicare and/or Medicare Advantage in your organizations operational plans? Do you monitor changes in market share when considering population changes moving forward?

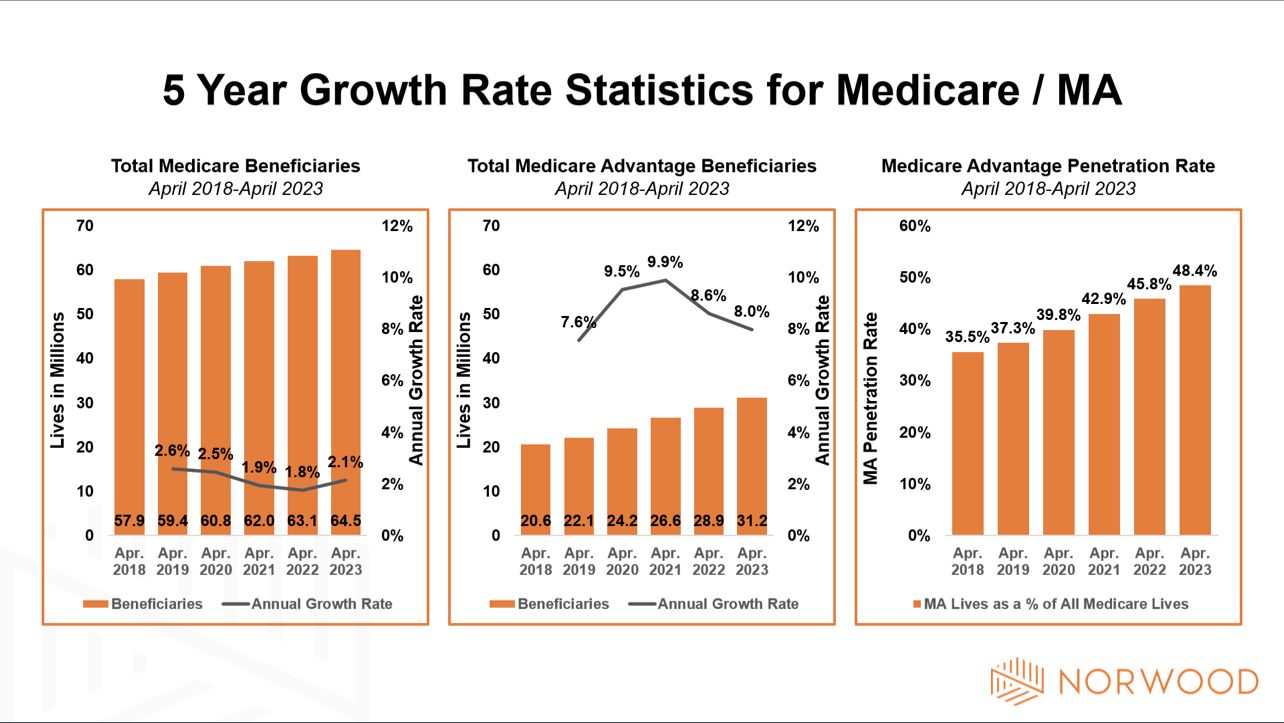

As of April, 2023 there are 64.4 million Medicare beneficiaries in the country. This has grown from 57.9 million in April, 2018. That is a 11.4% growth rate in five years. However, if you take a look at that growth a little deeper you will see the explosive growth in Medicare Advantage lives. During that same time period MA lives have soared from 20.6 million to 31.2 million. That is a 51.8% increase in the number of MA beneficiaries. You can see by the annual growth rates that enrollment in MA plans is soaring relative to Medicare growth. In fact, in April 48% of all Medicare beneficiaries now belong to a MA plan. This is up from 35% just five years ago. How is this evolution impacting you and what are you doing about it? Here are a few considerations:

Denials: recently the industry has been buzzing with the massive increase in denials. A quick google search for healthcare denials shows countless articles about the increases in denials and that many organizations see 10% plus denials. In my conversations with healthcare executives this is one of the top priorities for them. They discuss a surge here and how it is impacting cash flow and financial stability. Given the growth rates of MA, unless we see reason to believe otherwise, I think this will only continue to increase in the short run. Is your revenue cycle prepared for it?

Pre-Authorizations: Per a CMS report, in 2021 there were 35 million pre-auth requests from MA payers alone. That equated to 1.5 requests per member. However, not all payers are created equal. Some payers requested over 2.5 pre-auth requests per member on average. It is exciting to hear that UHC plans to cut requests significantly, but as of the 2021 data they actually sent significantly less requests than others. How much will this make a difference and how will you use what you know about your market’s dynamics to be able to prepare?

Risk Adjustment: this has been a hot topic for years, but what is new is where MA growth is coming from across the market. There are many states with historically low MA penetration rates (the percent of eligible beneficiaries enrolled in MA plans) that are seeing a surge in MA growth. How will this potentially disrupt MSSP and ACO REACH participants? Do you know your approximate market share for each county in your service area?

There are so many great questions that can be answered using data that is available. Do you use publicly available data? Are you using the data to your advantage? Are you lost and want to just chat about the market?

We help hospitals hospital better. Let us help.

Contact Jason at jason@norwood.com

Related News & Insights

Clinical Clarity: Navigating Problem Lists and Defensible Narratives with Dr. Trey LaCharite’

Listen to the full episode here: https://spotifyanchor-web.app.link/e/mQEUhXavSIb If you’ve ever been a member of ACDIS you’ve almost…

KDIGO Announces new Clinical Practice Guideline for the Evaluation and Management of CKD

By Brian Murphy According to the ACDIS 2023 CDI Week Industry Overview Survey, kidney disease was ranked…