Risk Adjustment, Prior Authorization Under Federal Spotlight at RISE Conference

By Jason Jobes, SVP Solutions

Last week I was at RISE in Nashville listening to a couple sessions on compliance. The first was with Christi Grimm from the Office of Inspector General (OIG). She called out three specific areas the OIG is focused on that I want to share here.

1) Medicare Prior Authorization. Delayed care and MA plan promises to uphold care expectations have become increasingly prevalent. The OIG will be expanding investigations into prior authorizations with the hope of rooting out care and payment delays for providers.

2) Risk Adjustment. As we have seen across the last two years this has been a key focal point. There is a push to move from revenue maximization to revenue accuracy for managed care plans and providers. Ms. Grimm stated that unless plans do more they can expect more scrutiny and oversight. She recommends using the shared methodology from the OIG toolkit to prevent, detect, and correct errors. You can find that here: https://oig.hhs.gov/oas/reports/region7/72301213.asp

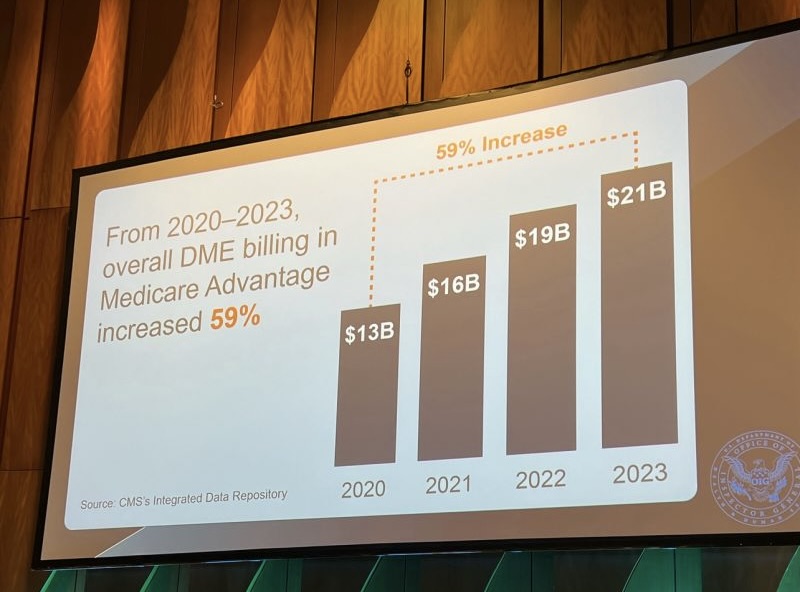

3) Fraud Committed Against Plans. As seen in the graphic below, there is a staggering amount of DME fraud across the country. The OIG has a commitment to driving improvement in this space and curbing the growth of fraud.

The second speaker was Edward Crooke from the Department of Justice (DOJ). The irony of an individual with the last name Crooke talking about fraud wasn’t lost on the audience.

In federal year 2023 the DOJ opened 443 new civil healthcare matters and settled $1.8B in healthcare cases. These are tremendous numbers. Additionally, in 2023 there were over $350M in payouts to whistleblowers. Let me repeat that. $350M in payouts. The financial incentives to be a whistleblower are tremendous.

Here is a sample of plan focused investigations:

- Kickbacks to Brokers and Other Referral Sources: Focused on corruption of the Medicare plan enrollment process.

- Overstating Risk Adjustment Complexity: This is focused on audits and chart reviews through the Medicare claims process. The plans can no longer have blinders on and fail.

- Risk Adjustment from Home Visits: While these have a place to provide needed care to beneficiaries who may not be able to access care in an office setting, the OIG/DOJ have concerns when these visits aren’t focused on improving care but solely on purely revenue generating programs.

- Queries and Addenda: Concerns exist with the timeliness of queries, the expectation that queries are approved in bulk, or that the queries are not material to the visit conducted.

- Medical Loss Ratio: The focus here is on the false representation of what is included in the MLR and if total MLR is being unfairly manipulated.

- Denial of Medically Necessary Care: This area was called out as a critical risk factor, and MA plans are seeing increased scrutiny about if the MAO plans are covering the services they are expected to cover.

Plans are not the only group being watched. Increasingly, provider groups and vendors can expect to see more oversight. Anyone who is encouraging or participating in the submission of false information with a focus on revenue maximization may be at risk.

Compliance at every step of the way isn’t a nice to have, it is an imperative.

If you weren’t at RISE and have questions about these sessions, or if you are an organization who isn’t sure of where you stand, please reach out to me. I am happy to share my thoughts.

Contact Jason at jason@norwood.com

Related News & Insights

NEJM Study: AI not Ready to Perform Basic Medical Coding, Let Alone Replace People

By Brian Murphy In the battle of artificial intelligence (AI) vs. humans, score one for humanity. Yeah,…

Transforming Episode Accountability Model (TEAM) Reconfirms CMS Commitment to Bundled Payments and Value-Based Care

By Brian Murphy Every time I think bundled payments are out, they drag me back in. I…