OIG targeted audits yield more immediate overpayments, but random audits may have more impact from extrapolation

Continuing the review of my findings from the OIG’s review reports (you can find links to parts 1 and 2 below), in this month’s issue of Mid-Revenue Cycle Minute I am turning my attention to random audits. Overall, there were only three random audits concluded and shared by the OIG in 2022-2023. In fact, the last one released was on September 26, 2022, over 19 months ago. This represents a small sample size … but the findings are impactful.

In each of these three audits, the OIG looked at 200 patients with at least 1 HCC and had a date of service in 2015. Let me pause, to repeat this is from 2015. I think as an industry there has been a lot of change since then. We have seen improved documentation, but we have also seen significant pressure on risk score maximization during that period.

During these audits reviewers found error rates (unsubstantiated HCCs) ranging from 3% to 10%. What I found somewhat remarkable is the volume of HCCs per patient was between 7.35-7.89. This to me seems like a significant outlier of “random” selection, given that the percentage of patients with 6+ HCCs is relatively low.

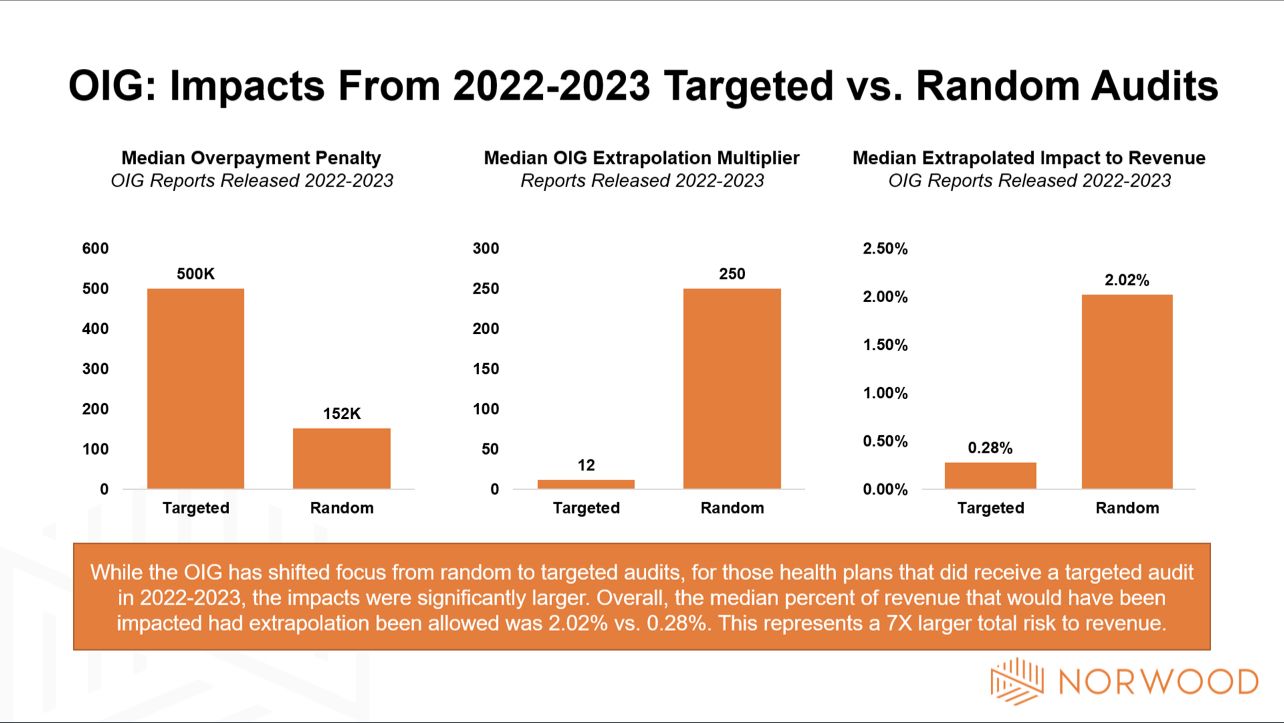

Overall, the overpayment of these reviews was fairly low. The organization penalized the most had a $217k penalty. In fact, the median was only $152k compared to a median of $500k from targeted reviews.

Why is this important? Targeted reviews have been a hot item with the OIG. In a period where they couldn’t extrapolate findings they were able to recoup a larger amount of overpayments from targeted audits. Now that extrapolation will be allowed beginning with 2018 dates of service, I project a resurgence of random audits. These random audits could increase impact by 7x, assuming the extrapolation methods previously used are supported.

Documentation continues to matter more and more. The emphasis on risk and risk-based payments continues to expand. Medicare Advantage and MSSP/REACH lives are at an all-time high.

The takeaway? Ensure that your documentation will stand the test of time.

Remember that this is what we do at Norwood, and can help you with revenue protection.

Have a wonderful week!

—Jason Jobes, SVP, Solutions

Norwood

Prior entries in the OIG audit series

Part 1: Analysis of 17 OIG reports reveals compliance blueprints for Medicare Advantage and provider organizations: https://www.norwood.com/analysis-of-17-oig-reports-reveals-compliance-blueprints-for-medicare-advantage-and-provider-organizations/

Part 2: OIG audits of Medicare Advantage reveal four eye-opening stats:

https://www.norwood.com/oig-audits-of-medicare-advantage-reveal-four-eye-opening-stats/

Related News & Insights

Norwood publishes analysis of CMS 2027 Advance Notice

Download the guide here. Medicare Advantage just shifted again — and 2027 is already reshaping your 2026…

Morbid obesity vs. Class 3 obesity for medical coding: Which to use—and which is accepted?

By Brian Murphy A mid-revenue cycle professional lamented on a recent call that their CDI program is…