By Brian Murphy

Many on the provider side of healthcare—including coding/billing/CDI/case management professionals—are not the biggest fans of Medicare Advantage (MA), aka, the semi-privatization of Medicare. MA has been under the spotlight recently for denying medically necessary care, as well as failing to demonstrate better outcomes despite charging higher premiums.

But I have to hand it to one MA organization for giving it back to the watchdog, in this case the Office of Inspector General (OIG).

If you haven’t yet read it, Cigna’s 33-page response to the August 2022 OIG report “Medicare Advantage Compliance Audit of Diagnosis Codes that Cigna HealthSpring of Florida, Inc. (Contract H5410) Submitted to CMS” is a model of how an organization that believes it is doing the right thing should stand up for itself. And rub a little salt in the wound at the same time.

But I’m not here to gloat or make light of things. This is serious business that speaks to the cost of healthcare in the United States and the complexities of our payment system.

Backstory is, the OIG reviewed 792 medical records of 200 sampled Cigna MA enrollees with at least one diagnosis code that mapped to an HCC for 2015, a total of 1,470 HCCs. Payments to Cigna for these patients totaled $3,998,157. After audit, the OIG reported that 1,401 of these were valid and 69 were not, and as a result Cigna received $39,612 of net overpayments.

That’s a very low error rate.

Cigna noted it was proud of its coding accuracy—greater than 95%–and it should be. That’s a standard almost any coder would be proud of, and this is a compliance rate in the face of an even higher stakes issue of OIG compliance.

Cigna next pushed back on handful of errors the OIG did point out, and identified 65 additional, unreported HCCs for the members in the audit sample. And as a result, Cigna claims it was underpaid (yes you read that right) in the audit sample:

We are proud of our performance in this audit. As reflected in the Draft Report, OIG and its medical record review contractor (“Contractor”) validated 1,379 of the 1,470 hierarchical condition categories (HCCs) in the audit sample; partially validated another nine HCCs based on related health statuses; validated an additional HCC that Cigna identified; and validated two additional HCCs identified by the contractor. Overall, the Draft Report indicates payment accuracy of 97 percent. We believe these results show that we have effective policies and procedures in place and have taken reasonable steps to ensure reasonable accuracy in our data.

Although these are stellar results, we believe that the Draft Report understates our true performance. As discussed below, we believe that sixty of the ninety-one HCCs that the Contractor did not validate should have been validated under the applicable statutes, regulations, and CMS guidance. In addition, we do not believe that the audit methodology adequately addressed potential underpayments, which may arise due to the conservative nature of many of our policies, procedures, and practices. Our review indicates that there are approximately sixty-five new HCCs that should be considered in the audit because they accurately reflect the individual member’s “health status,” which is the standard articulated in the statute. With those corrections, we believe the audit sample reflects a significant net underpayment.

The Cigna response then launches into a semi-editorial about the inherent subjectivity in coding, lectures the OIG on the fact that CMS does not hold MA organizations to a perfection standard, criticizes the OIGs audit methodology and timeliness (this audit covered claims with 2014 dates of service, requiring access to old and often inaccessible claims), and more.

If you like medical coding and reimbursement, it’s good reading, and speaks to the incredible complexity of our healthcare system. It underscores why coding and CDI professionals are so important. Hospitals that have been hit with a prior OIG audit were likely pumping their fist in the air at some of these passages.

Now, the OIG does extraordinary work keeping CMS and private payers honest. It protects the public trust (and funds) with what I believe is an incredible degree of integrity. The fact that it publishes such reports with full retort/criticism speaks volumes about its commitment to process and transparency. Bravo, OIG.

But the OIG is not perfect. It relies on contracted physician/nurse/coding auditors, who are paid to do the difficult, subjective work of chart reviews. Their job is to find errors, and because of the subjective nature of diagnosis and coding they’re not always right. I’ve had numerous conversations with providers citing similar audit problems as described by Cigna, most recently with a highly publicized malnutrition audit where elderly patients treated with Ensure and clear signs of cachexia saw OIG contractors dispute severe malnutrition claims. Cases where most reasonable clinicians (even non-clinicians) would likely side with the hospital. It’s not apparent who the subcontractors are. Cigna asked the OIG to identify who it used as an independent medical record review auditor; the OIG refused.

To take the other side, I’ve read many other published reports demonstrating the OIG exposing seemingly illegitimate claims and bad coding practice, and organizations admitting to fault and paying restitution. The number of MA lawsuits pending is long and growing longer.

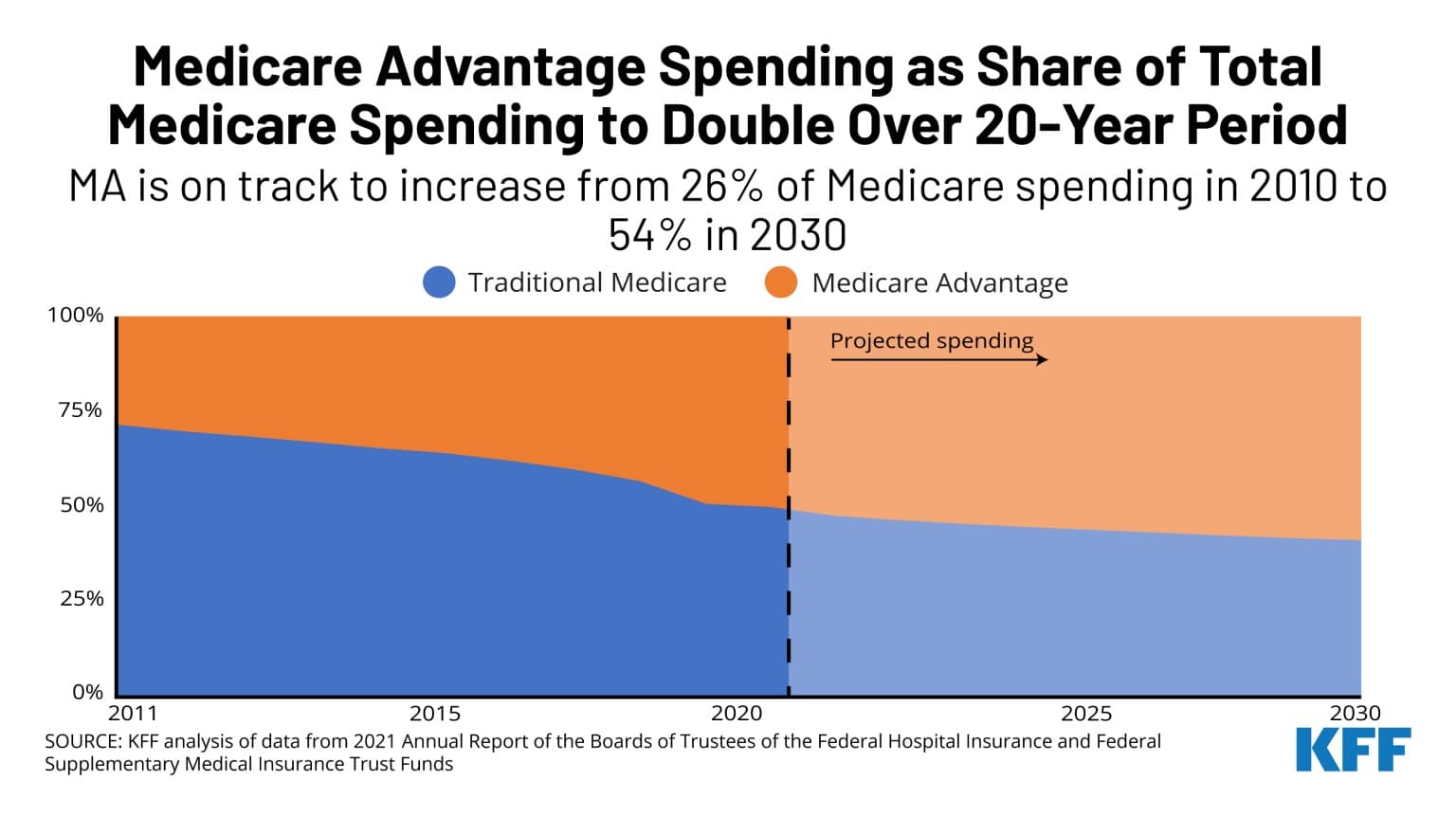

There is a lot of money flowing to MA organizations. Per the report, CMS paid Cigna HealthSpring approximately $845 million to provide coverage to approximately 57,000 enrollees, most of whom resided in counties in South Florida, for the 2015 payment year that was ultimately audited. For 2019, CMS paid MA organizations $274 billion, which represented 34 percent of all Medicare payments for that year. That’s a lot of taxpayer dollars; it has to be properly spent and monitored for compliance.

You might ask (fairly), surely there’s an alternative to this daily, pitched battle, with all its costs and inefficiencies, and he said/she said argumentation?

I would counter with: What’s your solution?

A transformation like a shift to single payer is not going to happen in the United States. The relentless growth of MA demonstrates that we’re headed in the opposite direction. MA is set to surpass traditional Medicare by percentage of covered lives.

Given this reality, we need a better process to adjudicate claims data submitted by private entities to CMS for the purposes of risk adjustment. What we have right now is messy and expensive. But it’s what we’ve got, and will continue to have, barring reform.

Here are a few possible fixes to help make a difficult and somewhat broken system better.

- More transparency, into true hospital costs and MA operating costs, to help set fair reimbursement rates.

- Better documentation, to provide support for claims submitted. Outpatient claims are often lagging in good documentation compared to inpatient.

- Clearer coding rules, such as enforcing that either a) the physician’s diagnosis is sacrosanct and must be coded, or b) rule that every diagnosis must clearly stand on its own in the documentation or be validated by a second party prior to submission.

- Good outpatient CDI programs that do the hard work of clinical validation and provider education, and properly trained coders who work with a high degree of accuracy. Cigna seems to have a pretty good compliance program that perhaps it might be willing to share with others.

- But what really has to happen is the actors in all of this—MA organizational leadership, physicians documenting the claims, CDI specialists querying for more specific diagnoses, HCC coders, and OIG employed auditors—must operate with integrity. They have to do what is right, and accurate, and truthful. Not what they think their employer wants to hear, or what is best for their quarterly shareholders. That’s easy for me to write, hard to do. Jobs are on the line. Careers, even. But it’s what has to be done.

For now the MA audits will continue, and the battle fought. We’ll have winners and losers. Today the winner was Cigna.

Related News & Insights

From Encephalopathy to Edema: Talking chart review with Dr. Tarman Aziz

Listen to the episode here. I’m consistently surprised at how few CDI or IP coding professionals talk about their most basic…

It’s OK to ask direct (but not leading) queries to the provider, CDI professionals

By Brian Murphy Ask direct queries. It’s OK. Sometimes we get so fixated on query format we…